Market Report

The Future of Labels and Release Liners to 2023

According to The Future of Labels and Release Liners to 2023, global label consumption is continuing to rise with sales set to hit $39 billion in 2018. Growth rates will continue to blossom, growing 4.0% annually over the next five years climbing to a $47.54 billion valuation in 2023.

Asia is the largest regional label market with a 47.0% share of global label consumption, and the fastest-growing in 2017. North America is the second largest region with a 20.0% share, followed by Western Europe with a share of 18.5%.

Exclusive research conducted by Smithers pinpoints seven trends that are boosting the industry:

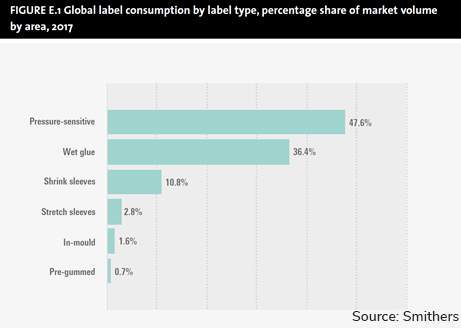

Stretch and shrink sleeves, along with pressure-sensitive labels, are forecast to grow at the fastest rates. Wet-glue, in-mould and pre-gummed labels are forecast to grow at significantly lower rates than the label market as a whole.

Pressure-sensitive labels are the largest category, representing a 47.6% share of global label consumption by area used and 61.1% by value in 2017. Wet glue is the second largest labels category with 36.4% of global label consumption by area and 19.8% by market share value.

Shrink-sleeve and stretch-sleeve formats will continue to improve their market share across 2018-2023 growing at 5.2% and 4.7% across the Smithers forecast period.

The main market driver for the uplift in sleeve consumption is the perceived marketing impact that is achieved by using full-body sleeves that provide 360° pack decoration. In addition, in a number of applications, shrink sleeves are also being used to fulfil a tamper-evident function, thus enabling the graphic content to be applied to the full surface of the label. The shrink-sleeve sector is also benefitting from technical advances for filmic materials.

End-use applications for labels are extremely diverse, ranging from food and drink to personal care and cosmetic products. Alcoholic drinks is the largest end-use market for labels, accounting for a 28.7% share of global label consumption by area in 2017. Soft drinks is the second largest end use sector accounting for 21.6%, followed by food and dairy with 15.7%.

Alcoholic drinks is the fastest-growing end-use sector for labels with growth forecast at 5.7% annually to 2023. The alcoholic drinks market for labels is supported by rising off-trade sales, a growing hospitality and tourism industry and increasing disposable incomes among an expanding middle class in Asia.

Wet-glue labels continue to retain a dominant position for alcoholic drinks. In contrast for food and dairy, soft drinks, pharmaceuticals, household products, cosmetics and personal care and industrial goods, pressure-sensitive labels are the leading type.

Digital printing continues to gain market share

Digital (toner and inkjet) printing grew at the fastest rate of any print process over the last five years. Digital presses are capitalising on growing demand for shorter run lengths and have started to make inroads into most label sectors. However, the indications are that their use is more economically suited to extremely short runs, and the likelihood of digital seriously challenging flexo for mainstream commercial work in the medium term is considered doubtful by many printers.

Despite this, digital printing is forecast to grow at the fastest rate of all label printing processes in the coming years. In response to the challenge posed by digital, flexographic equipment manufacturers are producing their own inkjet label presses and hybridising flexo equipment with inkjet print stations.

Labels and release liner consumption is being driven by several broader market factors. Demand will be driven primarily by the faster-growing, emerging and developing economies of Asia, the Middle East and Africa. This is due mainly to a migration from unpackaged to packaged products as a result of rising real incomes.

Despite the slower-growing advanced economies of developed regions, positives can be found. Ageing populations are good news for labels and release liners due to the increase in demand for pharmaceutical and healthcare products. The market is also being boosted by the rise in healthier food and drinks, convenience foods, smaller pack sizes and resealable packaging.

Source reduction and use of sustainable materials as a result of public concern over the disposal of waste packaging and labels are gaining much attention in the labels industry. Initiatives include the growing use of recycled paper and plastics, bioplastics and film downgauging.

Downgauging for cost reduction has been an important trend and converters have offered innovative technological advancements to supply downgauged label films with high functionality, reduced waste volumes and environmental benefits. However, the limit may have been reached in terms of producing thinner, lighter weight, label materials that are cost-effective and environmentally compatible. Further lightweighting developments could result in process inefficiencies.

Technological advancements are playing a vital role in supporting label and release liner industry development. New and improved technologies are not only driving down costs and improving label production efficiency, but are also opening up additional markets for label and release liner producers. Some of the key technology developments include: