LEATHERHEAD, Surrey, UK and AKRON, Ohio, USA – October, 14 2020 – Covid-19 disruption is highlighting the increased importance of packaging for the global print industry in 2020 and beyond.

Data from the latest Smithers print market study –

The Future of Package Printing to 2025 – shows this market will reach a projected global value of $431.6 billion in 2020, with the equivalent of 11.4 trillion A4 sheets printed. This reflects a slowing of growth as countries across the world have reacted to the coronavirus pandemic.

The packaging and labels sectors have shown strong resilience however, and some segments have even grown as consumers stockpile items, and move purchases to e-commerce channels. This contrasts with much larger drops in demand for publications, advertising and other graphic printing – accelerating trends that have been defining the print industry through the 2010s.

Growth in package print will continue through to 2025, reaching $491.1 billion and 13.1 trillion A4 sheet equivalents in that year – representative of a 2.6% CAGR by value – according to the Smithers forecast.

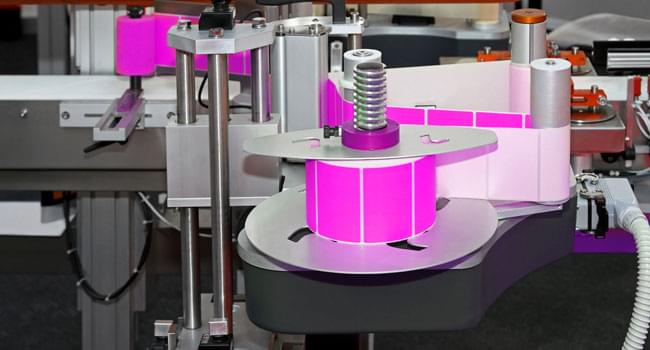

As they adjust to the new commercial realities, packaging and labelling will continue to be a key focus for OEMs, technology developers, consumables suppliers, and PSPs across the next five years.

By value, corrugated is the largest packaging type, followed by cartons and flexible packaging. Corrugated printed packaging is expanding through its use in primary packs and shelf-ready secondary packaging, and especially in 2020 in e-commerce sales. The increasing use in customer-facing applications demands higher print quality, and variable data customisation – which is being met by a new generation of high productivity single-pass inkjet presses.

Flexible substrates are benefitting from increased demand for low-cost, lightweight, convenient packaging; such as stand-up pouches, including retort and microwavable formats. There will be further growth in demand through to 2025; and new challenges for printers, as alternative easier to recycle materials are introduced to address concerns over plastic waste.

With the exception of screen printing, all packaging print processes will grow in value to 2025. Flexo will remain the most widely used print process with a particularly high share by volume due to its use for long runs on comparatively low-cost substrates.

Over the next five years the major transition will be the wider adoption of digital (inkjet and toner) print across multiple segments, especially corrugated. This will align with buyer demands for shorter runs, more customisation, and faster turnaround; which PSPs can leverage to improve service levels.

While well established in labels, there remain several market barriers to the further penetration of digital into other packaging segments. These include:

- Increased education across the supply chain of the benefits of digital

- Optimising designs for lower ink coverage, as inkjet inks and toners have a high price, even as scaling in supply reduces per-litre prices across 2020-2025

- Converters adapting operations to manage the increased flow of SKUs that can be generated with digital print

- Making printing more sustainable, as brand owners introduce pack designs with less plastic and new substrates.

From a regional perspective, Asia, North America and Western Europe make up 86% of the global package print market by value. Developing markets in Asia, Eastern Europe, the Middle East, and Africa will see the highest growth in demand for 2020-2025.

The market outlook for packaging print is analysed in depth and quantified in the new Smithers study –

The Future of Package Printing to 2025. This strategic business publication segments the industry (by value and volume) for 2015-2025 by print process, packaging material, world region, and the leading 15 national markets.

Find out more here.