The market for natural and synthetic rubber for non-tire applications was estimated at 13.9 million tonnes in 2021 and is expected to be 16.9 million tonnes by the end of 2027, with a compound average growth rate of 3.4 %, according to new research just released by Smithers. On the other hand, new report,

The Future on Natural and Synthetic Rubber for Non-Tire Applications, found that thermoplastic elastomers will likely to have grown at the rate of 5.1% from 3,371.1 thousand tonnes in 2021 to 4,628 thousand tonnes in 2022. If 2021 was considered to have been an improvement over 2020 for both groups of elastomers, the prognoses for the next few years are still cautiously positive.

Pricing volatility and market conditions

The COVID-19 pandemic has continued into 2022 and rapidly rising raw materials prices are sending ripples through the market with little sign of conditions quieting down. The move from internal combustion motor vehicles to electric vehicles has also caused a number of difficulties, not the least being the slow-down in vehicle production and falling vehicle sales. Some degree of growth in the medical sector has softened the blow, but not enough to compensate for the overall loss of business.

The Russo-Ukrainian conflict has exacerbated the situation, by creating severe shortages of oil and natural gas, to the extent that elastomer prices have rapidly increased and in some cases doubled compared with 2019. If this were not enough, there is currently a severe shortage of containers, coupled with rising transport costs, which is presenting the elastomer markets with extreme difficulties. Added to the overall confusion, many governments are tightening their monetary policies, which makes for difficulties in exporting and importing elastomers. As of the beginning of 2022, it appears that the afore-mentioned difficulties are likely to continue for some time.

Non-tire thermoset and thermoplastic elastomers

The simultaneous advent of several crises has badly affected the global non-tire and thermoplastic rubber markets, as it has for other branches of the world’s industries. This has led to a down-turn in the consumption of rubber for non-tire rubber markets, but since 2022 the market is showing a slow recovery. The various struggles in automotive industry have combined to create in a severe drop in the consumption of certain non-tire rubbers. The switch from ICE-powered vehicles to those powered by electric batteries has also resulted in a much lower consumption of certain non-tire rubbers, particularly those requiring high performance heat resistance.

Appliances, electronic and electrical

The outstanding electrical properties of non-tire thermoset elastomers make them useful in a wide variety of applications, such as white goods (seals), computers and portable telephones (keypads), razors grips, gardening equipment (hoses, lawnmowers, hand tools), etc. Chemical resistance, soft-touch, electrical insulation, weather resistance) are the properties appreciated by electrically powered tools.

Coatings, sealants, and adhesives

COVID-19 dramatically changed the nature of the retail market. Online purchasing boomed with many small retail businesses being replaced by mail ordering. This boosted the carton business, which in turn explains the growth in hot-melt and pressure sensitive adhesives based primarily on thermoset adhesives for their properties. Coatings made from thermoset rubbers exhibit excellent chemical and weathering resistance. Lastly sealants, which without thermoset rubbers would not function. The need for heat and chemical resistance combined with good compression set properties guarantee the future of thermoset elastomers.

Medical

Not all the current situations have been entirely negative. The impact of Covid-19 has given a welcome opportunity for growth in the medical elastomer sector: syringe components, masks and medical tubing have favoured the growth of thermoplastic elastomers. General hospital applications are seeing growth in rubber sheeting and hospital equipment.

Footwear

The advent of Covid-19 has been good for certain countries, in that the footwear industry has considerably expanded due to the various countries reducing the number of people meeting together. This resulted in people working from home and spending more time outside able to pursue their need for exercise, plus being able to dress casually. This has increased the sales of sport and casual footwear, to the advantage of certain thermoset and thermoplastic rubbers, especially natural rubber and styrene block copolymer-based thermoplastic elastomers.

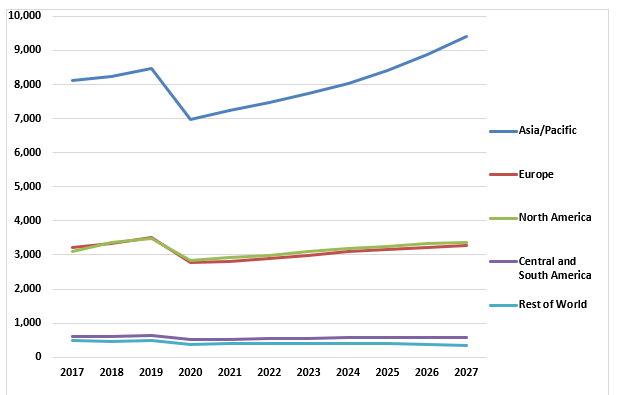

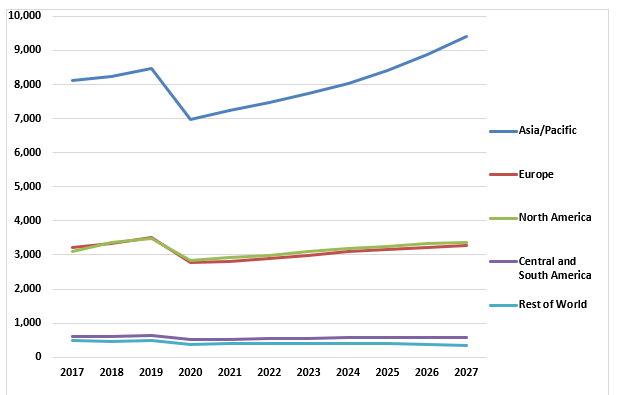

Regional trends

Individual regions and countries have been affected by the collection of setbacks already referred to. The reaction to each region and country has however been different to that of the end-use markets since the degree of industrialisation of each country varies considerably from country to country. Those countries having access to thermoset rubbers have favoured better than those having to import all their needed products. However, it is difficult to make too many comparisons, since other factors have played a role in the return, such as the growth of the individual industries and the rather dramatic increase in the price of all rubbers and transport costs.

The global market for non-tire thermoset elastomers for 2017 to 2027, by geographical region (‘000 tonnes)

Source: Smithers

Source: Smithers