While welcoming the concept of sustainability, consumers want products that are protected by materials that are routinely considered unsustainable. Single-use plastic packaging is the dominant solution for protecting pharmaceuticals, food, electronic components and other goods from the potential damage of moisture, oxygen, sunlight and other environmental impacts. However, after product use, the packaging cannot be used again, creating major attention from regulators, environmentally conscious consumers and evolving product manufacturers.

A new report from Smithers,

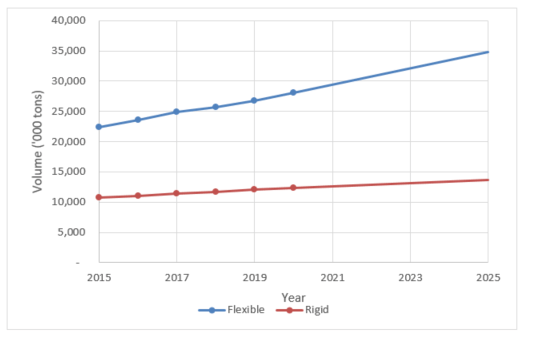

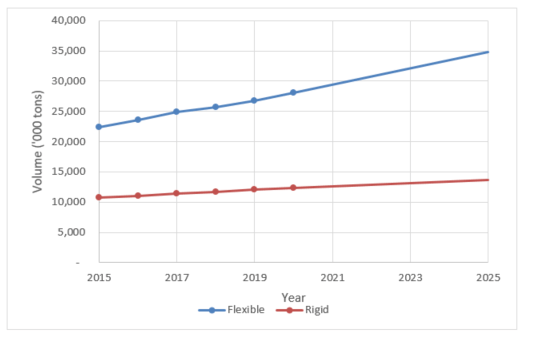

Future of Single-use Plastic Packaging in a Sustainable World: 2020 to 2025, outlines the response to growing interest in disposable plastic packaging and related sustainability concerns from consumers, plastic and plastic packaging companies, associations, environmental groups, governments and regulators around the world. Single-use plastic packaging use is projected at 40.4 million tons in 2020 and is forecast to grow during 2020–2025 at a CAGR of 3.7% to 48.5 million tons in 2025, according to the new Smithers research. The material will continue to change as the demand for sustainable packaging evolves. The predicted compound annual growth rate (CAGR) for the 2020 to 2025 is forecast at 3.7%, which is a decline from the annualized rate over the last five years at 4.0%.

Flexible packaging

Flexible packaging comprises 69% of the single-use plastic packaging market, while rigid packaging accounted for about 31%. CAGRs for both flexible and rigid packaging are predicted to decrease. Rigid packaging will decline the most in annualized rate from 2.7% to 2.0% due to packaging companies designing containers with less plastic and substitution with flexible packaging and other materials. Flexible packaging will slightly decline in annualized rate from 4.6% to 4.5% due to more flexible materials being recycled and package design being offset by population growth and increased consumer buying habits due to urbanization.

Single-Use Plastic Flexible and Rigid Packaging- Global Market 2020-2025 (Predicted)

by Type (Flexible or Rigid)

Source: Smithers

Legislation

Source: Smithers

Legislation

Many regulatory and legislative changes will affect the single-use plastic packaging market over the next five years, especially in the EU, North America, China and India. The European Commission’s definition of single-use plastics focuses on 10 single-use plastic items that cause ocean pollution, constituting 70% of all marine litter. The plastic items, which are being banned, include: cotton buds made with plastic, balloon sticks/balloons, food containers, beverage cups, beverage containers, cigarette butts, bags, crisp packets/sweet wrappers, and wet wipes /sanitary items. Of those items, only food containers, beverage cups/straws, beverage containers, bags, crisp packets/sweet wrappers are single-use plastic packaging.

Flexible packaging, such as single-use plastic packaging for wrapping meats, and rigid packaging, like Styrofoam® egg cartons and polyvinyl alcohol (PVC) blister packs for pharmaceuticals, are not mentioned. They may be part of the other 30% of marine litter items. Inherent in that EC’s definition is the consumer’s choice to not recycle (behavioral), and dispose of the plastic in other ways. The EC’s definition also does not consider the lack of recycling infrastructure. For example, crisp packets and sweet wrappers cannot be recycled since they cannot be sorted and get tied up in recycling facility processing equipment.

End-use applications

End-use applications are important as single-use plastic packaging provides protection for products. The three largest segments for plastic packaging are food, personal care and pharmaceutical and medical. These segments represent ~85% of disposable plastic packaging. For 2020, the food segment is predicted to be have about 64% market share, while personal care is almost 13%, and pharmaceutical and medical is a little over 8%.

For the food segment, meat, fish and poultry packaging is the greatest sub-segment. The snacks and frozen food sub-segments have the fastest CAGR for both the last five- and future five-year periods, due to faster and urbanized lifestyles. Egg packaging (i.e., eggshells) containing Styrofoam (foamed polystyrene) is predicted to have a negative growth rate due to legislation and viable recycling alternatives- polyethylene terephthalate (PET) and paper.

Trends in plastic type

For single-use plastic flexible films, each polymer type provides specific properties. For example, bi–oriented polypropylene (BOPP), bi–oriented polyethylene terephthalate (BOPET), and Biaxially oriented polyamide (BOPA) are used for strength. Ethylene vinyl alcohol (EVOH), polyvinyl alcohol (PVC) and polyvinylidene dichloride (PVDC), and metallicized plastic films are used for their high barrier (moisture and air) properties. These attributes are the reason for use of single-use plastic packaging. The volumes reflect that the base or strength polymers are greater than the barrier polymers due to cost and optimization of multi-layered films.

Flexible packaging with multiple plastics, either from co-extrusion or lamination, is disposable because of the inability for MRF equipment to sort, separate, and process by plastic type, a lack of a suitable recycling infrastructure, and economics. However, there is active research in sorting, separating and processing packaging having multiple polymers. This R&D will not significantly alter the disposable plastic packaging market by 2025.

For more information,

download the brochure here.