Market Report

The Future of Sack and Kraft Paper to 2023

Global sack and bag kraft production amounted to 17.4 million tonnes in 2017 according to the exclusive research from Smithers. This was worth $16.1 billion to paper mills, and will climb moderately to a projected $16.5 billion in 2018. The total value to sack and kraft converters in this market is around $43.0 billion in 2017.

Analysis within The Future of Sack and Kraft Paper to 2023 tracks how total production of paper bags and sacks will reach 20.7 million in tonnes by 2023, growing on average of 2.9% per annum across the next five years. This contrasts with a growth rate of just under 4% for the preceding five-year period. The total value of the market at the end of the Smithers study period will be just over $19 billion to paper mills, and $50.9 billion to converters.

This market, which includes all non-specialty flexible paper packaging made from sack kraft, and kraft papers, is relatively fragmented. In 2017 there were over 300 sack and kraft paper manufacturers worldwide, with the 20 largest producers representing under 30% of the total volume.

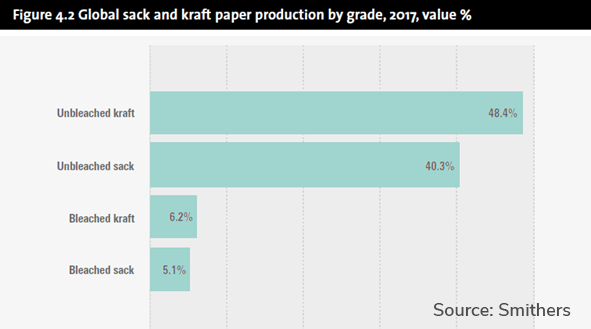

In 2017, 89% of the market by volume was unbleached sack or kraft paper, with bleached products accounting for the balance of 11%. It is anticipated that demand for bleached papers will continue to grow at above the market average, gradually increasing their market share from 11.3% in 2017 to almost 12% by 2023 in volume terms. Increasing demand for more sophisticated finishes on these papers will see coated products grow at above-average rates, with their share improving from over 17% in 2017 to more than 20% in 2023.

The sack and kraft market will be subject to a number of influences across 2018-2023, which will shape its evolution. The most important of these identified by Smithers analysis are:

Growing demand for sack kraft – especially from Asia-Pacific, the Middle East and North Africa – is putting pressure on the European supply chain. Converters have been reporting delayed deliveries, extended lead times and general difficulty in sourcing. This has been exacerbated by temporary shut-downs of some mills, coupled with some US producers switching from kraft papers to containerboard.

In reaction there have been price increases. Two in January and July 2017, moved unbleached prices upwards by around $100 per tonne on average, with bleached prices showing a more modest increase of around $70 per tonne. There have also been reports of some producers resorting to ‘rationing’ – introducing limits on order sizes – although more paper can be bought, this includes a cost premium.

The medium-term reaction to the rise in sack and kraft pricing has been to invest in new paper machines to feed it. Total industry capacity for sack and kraft papers in 2017 is estimated to be slightly over 21 million tonnes.

It is estimated that an additional net 140,000 tonnes of new capacity came on stream last year, with over 100,000 tonnes alone from Russian company Segezha, which acquired a new PM11 paper machine in October 2017.

BillerudKorsnäs is restarting its 100,000 tonne MG paper machine (PM10) at Tervasaari, Finland. This is expected to produce some 40,000 of white MG paper during the second half of 2018, and will be fully operational by the end of 2019.

In contrast, around 50,000 tonnes of capacity was in 201 lost due to mill closures, machine shutdowns or grade switches. And more than 250,000 tonnes of capacity is at risk of closure due to increasingly tight operating conditions for Canadian Kraft Paper Industries and Nippon Paper’s Australian operations.

Averaging these moves out, Smithers estimated that a net increase in total industry capacity of around 300,000 tonnes will take place over the next two years.

Furthermore, over 500,000 tonnes of capacity is expected to change hands in Q3 of 2018, when WestRock will complete its acquisition of Kapstone for a price of $3.5 billion.

Sack and kraft will continue to face completion from a range of plastic materials – with developments in plastic-based pouches and flat-bottomed formats in consumer applications. This is likely to be ameliorated by the current pressure against plastic packaging due to its poor recyclability, and may benefit certain sectors (see below). Overall this will not be a long-term shift however once adequate technologies to collect, separate and reprocess polymer formats are developed and implemented. Though, as with the consumer attitudes to plastic formats, this roll-out will not be uniform across all markets worldwide.

Sack and bag producers are also confronting the ongoing erosion of their market in bulk distribution systems, due to the rising sophistication and popularity of flexible intermediate bulk containers (IBCs), and bulk bags. These are especially prevalent in industrial goods, and are hampering growth in sack demand, as they have a number of both real and perceived advantages to users.

A number of leading brands have adapted their packaging formats to capitalise on the brown appearance of kraft papers lending a ‘natural’ or ‘earthy’ feel to their products. This is particularly evident for retail shopping bags – which can present an environmentally favourable image for a brand – and increasingly in primary packs for products such as dry groceries and toiletries.

Mondi, for example, has developed a new product that targets premium creative print and packaging applications, including shopping bags. Petrographic Infinite Black paper has better folding and varnishing properties and a food safety certification.

E-commerce related developments have also contributed to the premiumisation of kraft packaging. The arrival of newer high-throughput digital print systems is also aiding this trend with their ability to impart high-quality graphics on short print runs for versioned packaging.

The Future of Sack and Kraft Paper to 2023 is available to purchase now, giving a comprehensive analysis of this total global market across all key metrics – geographic region, paper grade and end-use application. For more information download the brochure.